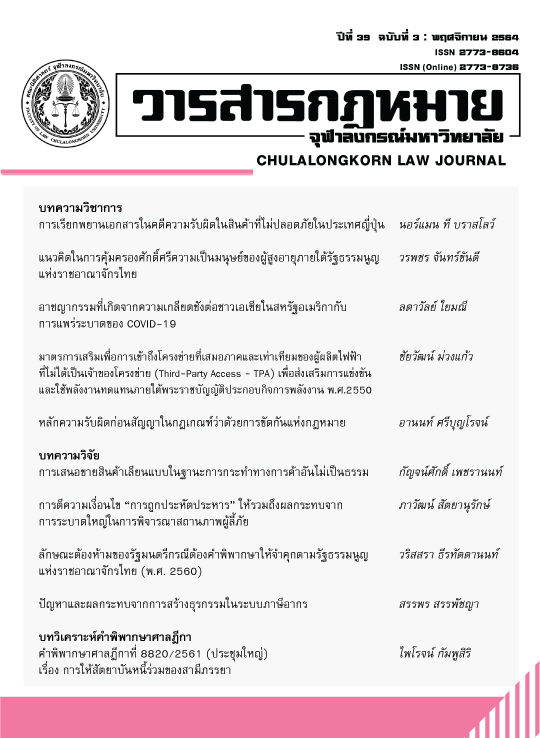

ปัญหาและผลกระทบจากการสร้างธุรกรรมในระบบภาษีอากร

Main Article Content

บทคัดย่อ

การสร้างธุรกรรมในระบบภาษีอากรเป็นการกระทำที่เป็นการหลีกเลี่ยงภาษีอากรและไม่ถูกยอมรับโดยประเทศต่าง ๆ ในปัจจุบัน เนื่องจากการสร้างธุรกรรมในระบบภาษีอากรปราศจากวัตถุประสงค์ทางเศรษฐกิจหรือธุรกิจและมุ่งแต่เพียงการรับเอาสิทธิประโยชน์ทางภาษีอากร การสร้างธุรกรรมในระบบภาษีอากรนี้มิได้จำกัดแต่เพียงธุรกรรมในประเทศเท่านั้น แต่รวมถึงธุรกรรมระหว่างประเทศด้วย สาเหตุสำคัญที่ทำให้เกิดการสร้างธุรกรรมทางภาษีอากรเกิดจากความสมัครใจของผู้เสียภาษีที่อยู่ในระดับต่ำ การปฏิบัติตามกฎหมายภาษีอากรมีต้นทุนที่สูง และความสามารถในการจัดเก็บภาษีและบังคับใช้กฎหมายภาษีไม่มีประสิทธิภาพ จากการศึกษาพบว่าการสร้างธุรกรรมในระบบภาษีอากรก่อให้เกิดปัญหาและผลกระทบหลายประการ กล่าวคือ ผลกระทบต่อรายได้ของรัฐ ปัญหาความไม่เป็นธรรมระหว่างผู้เสียภาษี ปัญหาการขัดต่อวัตถุประสงค์ของอนุสัญญาภาษีซ้อน และปัญหาการเป็นอุปสรรคต่อการแลกเปลี่ยนผลประโยชน์ระหว่างรัฐ

Article Details

ลิขสิทธิ์และเนื้อหาในเว็บไซต์ของวารสารกฎหมาย (รวมถึง โดยไม่จำกัดเฉพาะ เนื้อหา รหัสคอมพิวเตอร์ งานศิลป์ ภาพถ่าย รูปภาพ ดนตรีกรรม โสตทัศนวัสดุ) เป็นกรรมสิทธิ์ของวารสารกฎหมาย และผู้ได้รับการโอนสิทธิทุกราย

1. วารสารกฎหมาย ให้อนุญาตให้คุณใช้สิทธิอันไม่เฉพาะเจาะจงที่สามารถถูกถอนเมื่อใดก็ได้ โดยไม่มีค่าใช้จ่าย ในการ

- เยี่ยมชมเว็บไซต์และเอกสารในเว็บไซต์นี้ จากคอมพิวเตอร์หรือเครื่องมือสื่อสารผ่านเว็บบราวเซอร์

- คัดลอกและจัดเก็บเว็บไซต์และเอกสารในเว็บไซต์นี้บนลงคอมพิวเตอร์ของคุณผ่านระบบความจำ cache

- สั่งพิมพ์เอกสารจากเว็บไซต์นี้สำหรับการใช้ส่วนตัวของคุณ

- ผลงานที่ได้รับการตีพิมพ์โดยวารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัย ถูกคุ้มครองภายใต้ Creative Commons Attribution 4.0 International License ซึ่งอนุญาตให้ทุกคนสามารถคัดลอก แจกจ่าย ดัดแปลง ส่งต่อ ผลงานได้ ก็ต่อเมื่อผลงานและแหล่งข้อมูลได้รับการอ้างอิงอย่างเหมาะสม

2. วารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัย สงวนสิทธิ์ไม่อนุญาตให้คุณใช้สิทธิอื่นใดที่เกี่ยวข้องกับเว็บไซต์และเอกสารบนเว็บไซต์นี้ เช่น การคัดลอก ดัดแปลง เปลี่ยนแปลง ส่งต่อ ตีพิมพ์ แจกจ่าย เผยแพร่ จัดแสดงในที่สาธารณะ ไม่ว่าจะในรูปแบบใดก็ตาม ซึ่งเว็บไซต์หรือเอกสารบนเว็บไซต์ โดยไม่อ้างอิงถึงแหล่งข้อมูลหรือโดยไม่ได้รับอนุญาตเป็นลายลักษณ์อักษรจากวารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัย

3. คุณอาจขออนุญาตที่จะใช้เอกสารอันมีลิขสิทธิ์บนเว็บไซต์นี้โดยการเขียนอีเมลล์มายัง journal@law.chula.ac.th

4. วารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัย เข้มงวดกับการคุ้มครองลิขสิทธิ์อย่างมาก หากวารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัยพบว่าคุณได้ใช้เอกสารอันมีลิขสิทธิ์บนเว็บไซต์นี้โดยไม่ถูกต้องตามการอนุญาตให้ใช้สิทธิ ดังที่กล่าวไปข้างต้น วารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัยอาจดำเนินคดีตามกฎหมายต่อคุณได้ เพื่อเรียกร้องค่าเสียหายที่เป็นตัวเงินและคำขอชั่วคราวให้คุณหยุดการใช้เอกสารดังกล่าว ทั้งนี้ คุณอาจถูกสั่งให้ชดใช้ค่าใช้จ่ายใดๆ ที่เกี่ยวข้องกับการดำเนินการตามกฎหมายนี้

หากคุณพบเห็นการใช้เอกสารอันมีลิขสิทธิ์ของวารสารกฎหมาย จุฬาลงกรณ์มหาวิทยาลัย ที่ขัดหรืออาจขัดต่อการอนุญาตให้ใช้สิทธิดังที่ได้กล่าวไปข้างต้น โดยเชื่อว่าได้ละเมิดลิขสิทธิ์ของคุณหรือของผู้อื่น สามารถร้องเรียนมาได้ที่ journal@law.chula.ac.th