Random Walk down the SET, Can We Really Beat the Market Using Simple Technical Analysis?

Abstract

Abstract

This study examines the potential benefit of employing the most commonly used technical trading strategies on the Thai stock market. The study is based on the Stock Exchange of Thailand (SET) Index over the period of April 1975 to April 2006. Two hundreds and eighty eight different moving average and eighty different trading range break trading rules. In the presence of transaction costs which are measured through our new method, results show that both variable-length and fixed-length moving average rule rules generate extra returns as compared to the buy-and-hold strategy. The trading-range-break rules, even though have return predictability, in some cases underperform the buy-and-hold strategy due to an inability to generate enough return to compensate for the commission fee.

Downloads

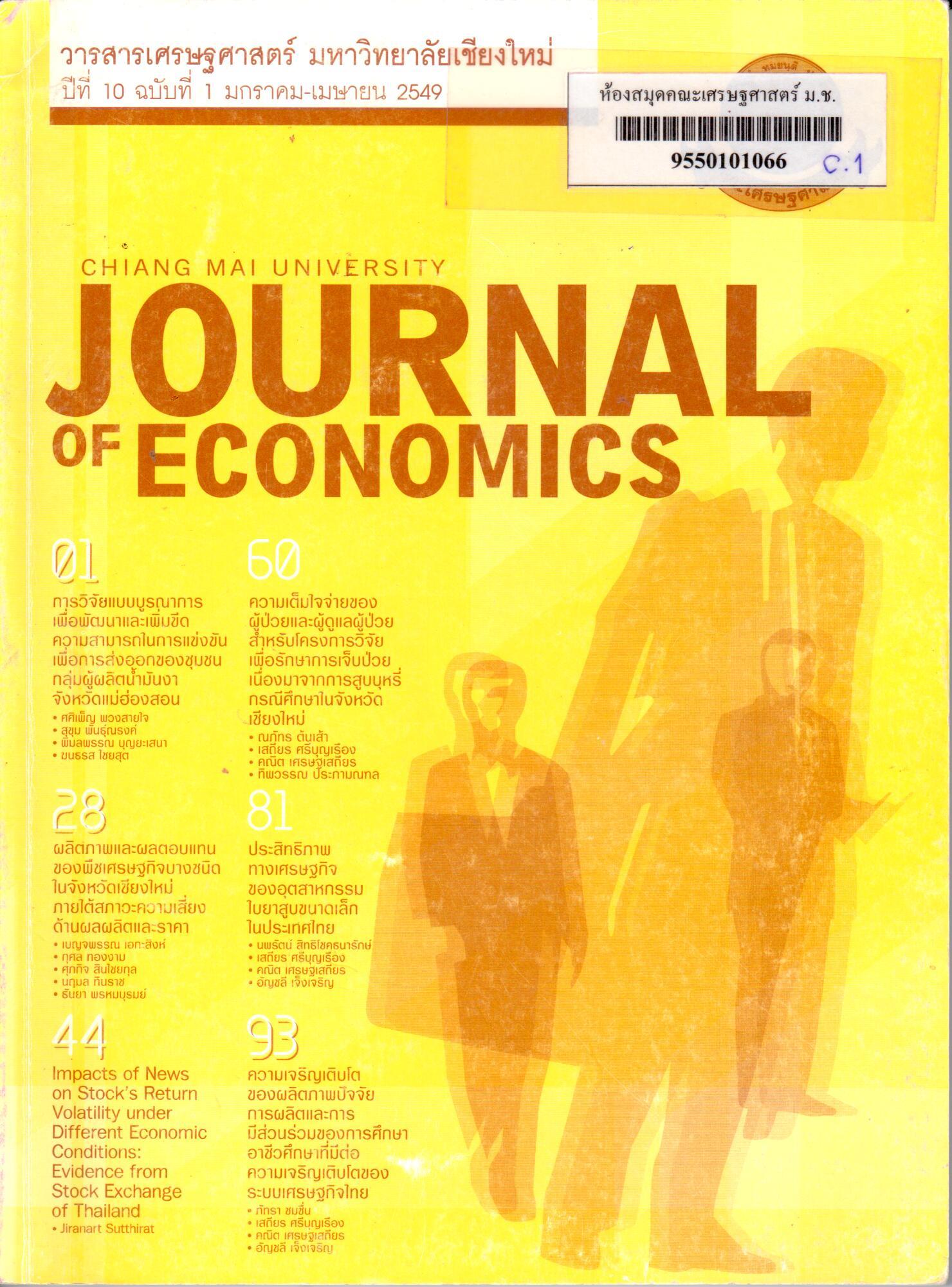

Issue

Section

License

All opinions and contents in the CMJE are the responsibility of the author(s). Chiang Mai University Journal of Economics reserves the copyright for all published materials. Papers may not be reproduced in any form without the written permission from Chiang Mai University Journal of Economics.