Antecedents of Stakeholder Relationships for Competitive Advantages and Investor Trust Influencing the Corporate Sustainability of Companies listed on the Stock Exchange of Thailand

DOI:

https://doi.org/10.14456/psruhss.2024.17Keywords:

Stakeholder relationships, Competitive advantages, Investor trust, Corporate sustainability, The stock exchange of thailandAbstract

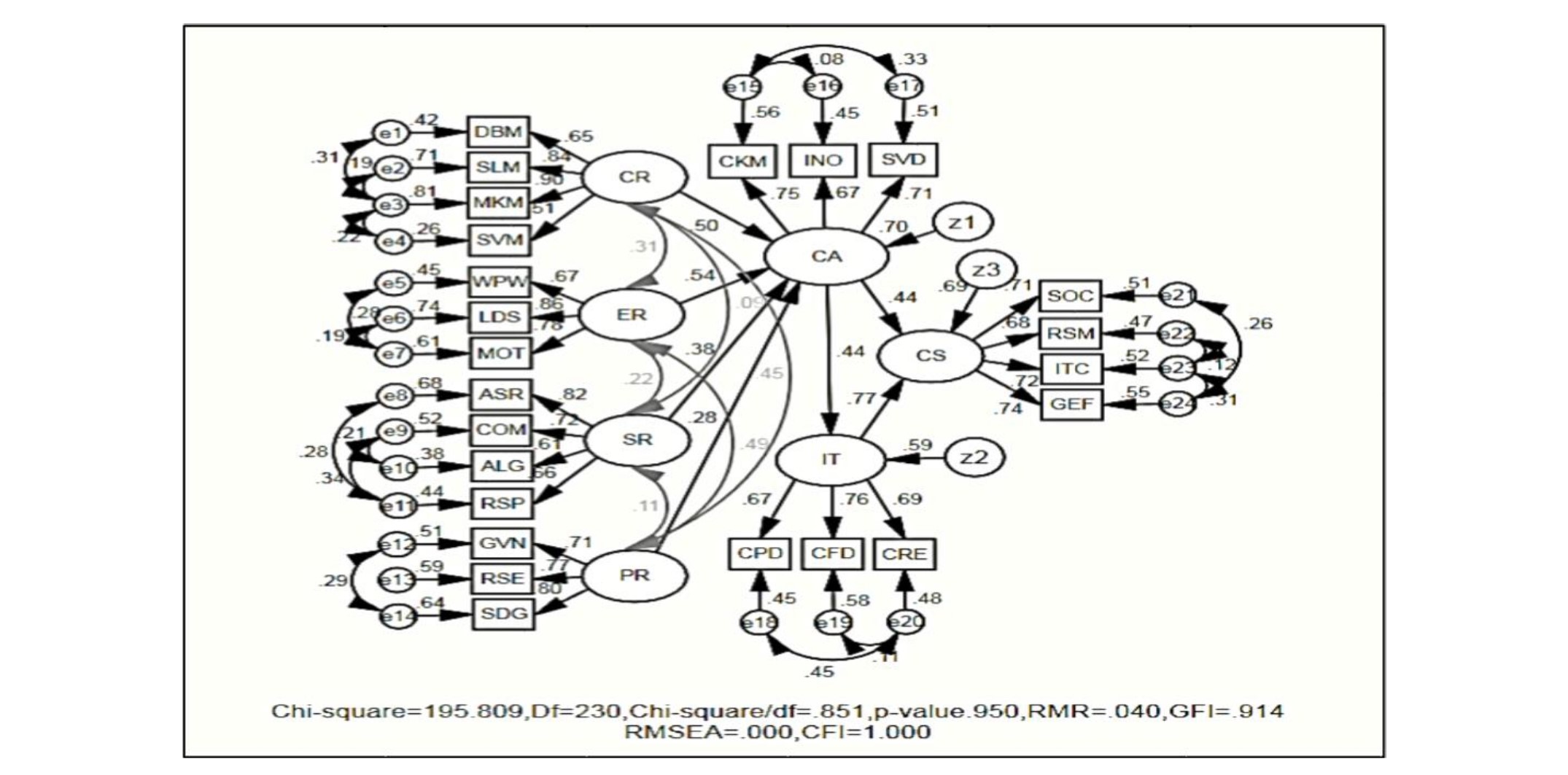

The purposes of this study were to 1) the causal relationship model of corporate sustainability of companies listed on the Stock Exchange of Thailand consisted of stakeholder relationships, the firm’s competitive advantages, and investor trust was congruent with the empirical data, and 2) stakeholder relationships, firm’s competitive advantages, and investor trust had a significant effect on corporate sustainability of companies listed on the Stock Exchange of Thailand. The information was gathered through 422 sets of questionnaires distributed to companies listed on the Stock Exchange of Thailand. The inferential statistical method was used to test hypotheses using structural equation modeling. The findings revealed as follows: 1) The research model was congruent with the empirical data (Chi-square/df = .851, p-value = .950, RMR = .040, GFI = .914, RMSEA = .000, and CFI = 1.000) and 2) Stakeholder relationships: employee relationships, customer relationships, supplier relationships, and public relationships had a significant direct effect on firm’s competitive advantages were equal to .543, .501, .384 and .283 respectively, Firm’s competitive advantages had a significant direct effect on both corporate sustainability of companies and investor trust were equal to .444 and .441 respectively and Investor trust had a significant direct effect on corporate sustainability of companies was equal to .772.

References

ตลาดหลักทรัพย์แห่งประเทศไทย. (2565). กลุ่มอุตสาหกรรมและหมวดธุรกิจในตลาดหลักทรัพย์แห่งประเทศไทย. สืบค้น 15 ตุลาคม 2565, จาก https://www.set.or.th/th/market/get-quote/stock/

นรีรัตน์ สันธยาติ. (2561). ภาคตลาดทุนทั่วโลก ผนึกกำลังเดินหน้าขับเคลื่อนการพัฒนาที่ยั่งยืนในเวที UN SSE Global Dialogue 2018. สืบค้น 21 มิถุนายน พ.ศ. 2565, จาก https://www.setsustainability.com/download/y32m9eb7dq86xkt

ปิยารมย์ ปิยะไทยเสรี. (2561). IPO Roadmap เส้นทางสู่การเป็นบริษัทจดทะเบียน. กรุงเทพฯ: ศูนย์ส่งเสริมการพัฒนาความรู้ตลาดทุน (TSI).

Abdioglu, N. (2020). The Role of Corporate Sustainability on Firm Value: An Application on Borsa Istanbul. In Handbook of Research on Creating Sustainable Value in the Global Economy. Pennsylvania: IGI Global.

Alvino, F., Di Vaio, A., Hassan, R., & Palladino, R. (2020). Intellectual capital and sustainable development: A systematic literature review. Journal of Intellectual Capital, 22(1), 76-94.

Amel-Zadeh, A., & Serafeim, G. (2018). Why and how investors use ESG information: Evidence from a global survey. Financial Analysts Journal, 74(3), 87-103.

Arimie, J. C., & Oronsaye, A. O. (2020). Assessing Employee Relations and Organizational Performance: a Literature Review. International Journal of Applied Research in Business and Management, 1(1), 1-17.

Awan, U., Kraslawski, A., & Huiskonen, J. (2017). Understanding the relationship between stakeholder pressure and sustainability performance in manufacturing firms in Pakistan. Procedia Manufacturing, 11, 768-777.

Bajo, E., Croci, E., & Marinelli, N. (2020). Institutional investor networks and firm value. Journal of Business Research, 112, 65-80.

Bardos, K. S., Ertugrul, M., & Gao, L. S. (2020). Corporate social responsibility, product market perception, and firm value. Journal of Corporate Finance, 62, 101588.

Brhane, H., & Zewdie, S. (2018). A literature review on the effects of employee relation on improving employee performance. International Journal in Management and Social Science, 6(4), 66-76.

Cepeda-Carrion, I., Martelo-Landroguez, S., Leal-Rodríguez, A. L., & Leal-Millán, A. (2017). Critical processes of knowledge management: An approach toward the creation of customer value. European Research on Management and Business Economics, 23(1), 1-7.

Chandrika, P. (2017). Impact of Internal Marketing on Human Resource Management–A study. IOSR Journal of Business and Management (IOSR-JBM), 6(4), 15-20.

Contini, M., Annunziata, E., Rizzi, F., & Frey, M. (2020). Exploring the influence of Corporate Social Responsibility (CSR) domains on consumers’ loyalty: an experiment in BRICS countries. Journal of Cleaner Production, 247, 119158.

Cronbach, L. J. (1970). Essentials of Psychological Testing. New York: Harper & Row.

Dakhlallh, M. M., Rashid, N., Abdullah, W. A. W., Qawqzeh, H. K., & Dakhlallh, A. M. (2020). Accrual-based Earnings Management, Real Earnings Management and Firm Performance: Evidence from Public Shareholders Listed Firms on Jordanian's Stock Market. Journal of Advanced Research in Dynamical and Control Systems, 12(1), 16-27.

Distanont, A., & Khongmalai, O. (2020). The role of innovation in creating a competitive advantage. Kasetsart Journal of Social Sciences, 41(1), 15-21.

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Boston: Pitman.

Gil-Gomez, H., Guerola-Navarro, V., Oltra-Badenes, R., & Lozano-Quilis, J. A. (2020). Customer relationship management: digital transformation and sustainable business model innovation. Economic research-Ekonomska istraživanja, 33(1), 2733-2750. https://doi.org/10.1080/1331677X.2019.1676283

Guiral, A., Moon, D., Tan, H. T., & Yu, Y. (2020). What Drives Investor Response to CSR Performance Reports?. Contemporary Accounting Research, 37(1), 101-130.

Hadj, T. B. (2020). Effects of corporate social responsibility towards stakeholders and environmental management on responsible innovation and competitiveness. Journal of Cleaner Production, 250, 119490. https://doi.org/10.1016/j.jclepro.2019.119490

Hair, J. F. (Jr.), Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks, CA: Sage Publications.

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate Data Analysis (7th ed.). New York: Pearson Prentice Hall.

Hakanen, M. (2017). The development and management of interpersonal trust in a business network in health, exercise, and wellbeing markets (Doctoral dissertation). University of Jyväskylä.

Jan, A. A., Lai, F. W., Draz, M. U., Tahir, M., Ali, S. E. A., Zahid, M., & Shad, M. K. (2021). Integrating sustainability practices into islamic corporate governance for sustainable firm performance: from the lens of agency and stakeholder theories. Qual Quant, 56, 2989–3012. https://doi.org/10.1007/s11135-021-01261-0

Javed, M., Rashid, M. A., Hussain, G., & Ali, H. Y. (2020). The effects of corporate social responsibility on corporate reputation and firm financial performance: Moderating role of responsible leadership. Corporate Social Responsibility and Environmental Management, 27(3), 1395-1409.

Kline, R. B. (2005). Principles and practice of structural equation modeling (2nd ed.). New York: Guilford Press.

Kumar, P., & Firoz, M. (2022). Does Accounting-based Financial Performance Value Environmental, Social and Governance (ESG) Disclosures? A detailed note on a corporate sustainability perspective. Australasian Accounting, Business and Finance Journal, 16(1), 41-72. http://dx.doi.org/10.14453/aabfj.v16i1.4

Kusumadewi, R. N., & Karyono, O. (2019). Impact of service quality and service innovations on competitive advantage in retailing. Budapest International Research and Critics Institute-Journal (BIRCI-Journal), 2(2), 366-374. https://doi.org/10.33258/birci.v2i2.306

Maharantika, S. F., & Fuad, F. (2022). The influence of environmental performance, environmental management systems, and corporate social responsibility disclosure on the financial performance. Diponegoro Journal of Accounting, 11(1), 1-15.

Maheshwari, P., & Kushwah, B. S. (2019). Customer loyalty approach of CRM. Journal of the Gujarat Research Society, 21(16), 64-72.

McCarthy, E. J. (1960). Basic Marketing, A managerial approach. Richard D. Irwin.

Meyer, J. M. (2015). Engaging the everyday: environmental social criticism and the resonance dilemma. Cambridge, MA: MIT Press.

Migdadi, M. M. (2020). Knowledge management, customer relationship management and innovation capabilities. Journal of Business & Industrial Marketing, 36(1), 111-124.

Mo, C. J., & Yu, T. (2022). Capturing complex, dynamic customer loyalty by integrating traditional and big data analyses. In Handbook of Research on Customer Loyalty. Massachusetts: Edward Elgar Publishing.

Naveed, M., Sohail, M. K., Abdin, S. Z., Awais, M., & Batool, N. (2020). Role of ESG disclosure in determining asset allocation decision: An individual investor perspective. Paradigms, 14(1), 157-166.

Nawrocki, T. L., & Szwajca, D. (2019). Corporate Reputation and Assessment of Companies by the Capital Market: Evidence from the Polish Banking Sector. Organization and Management Scientific Quarterly, 3(47), 111-121.

Nugroho, T. W., Hanani, N., Toiba, H., & Sujarwo, S. (2022). Promoting Subjective Well-Being among Rural and Urban Residents in Indonesia: Does Social Capital Matter?. Sustainability, 14(4), 2375. https://doi.org/10.3390/su14042375

Oliver, R. K., & Webber, M. D. (1982). Supply-chain management: logistics catches up with strategy, in Christopher, M. (1992), Logistics: The Strategic Issues, London: Chapman & Hall.

Ozmen, Y. S. (2017). How Employees Define Organisational Trust: Analysing Employee Trust in Organisation. Journal of Global Responsibility, 9(1), 21-40.

Pahurkar, R. N., Sangvikar, B. V., Khadke, K., & Kolte, A. (2020). An Exploratory Study of Important Dimensions in Strengthening Buyer-Supplier Relationship. International Journal on Emerging Technologies, 11(2), 803-810.

Pancasila, I., Haryono, S., & Sulistyo, B. A. (2020). Effects of work motivation and leadership toward work satisfaction and employee performance: Evidence from Indonesia. The Journal of Asian Finance, Economics, and Business, 7(6), 387-397.

Park, J. H., & Tran, T. B. H. (2018). Internal marketing, employee customer oriented-behaviors, and customer behavioral responses. Psychology & Marketing, 35(6), 412-426.

Patrucco, A. S., Moretto, A., Luzzini, D., & Glas, A. H. (2020). Obtaining supplier commitment: antecedents and performance outcomes. International Journal of Production Economics, 220, 107449. https://doi.org/10.1016/j.ijpe.2019.07.022

Porter, M. E. (1985). The Competitive Advantage: Creating and Sustaining Superior Performance. NY: Free Press.

Rizwan, A., & Mustafa, F. (2022). Fintech attaining sustainable development: an investor perspective of crowdfunding platforms in a developing country. Sustainability, 14(12), 7114.

Rovinelli, R. J., & Hambleton, R. K. (1977). On the use of content specialists in the assessment of criterion-referenced test item validity. Dutch Journal of Educational Research, 2, 49-60.

Schermelleh-Engel, K., Moosbrugger, H., & Muller, H. (2003). Evaluating the fit of structural equation models: tests of significance and goodness-of-fit models. Methods of Psychological Research Online, 8(2), 23-74.

Stocker, F., de Arruda, M. P., de Mascena, K. M., & Boaventura, J. M. (2020). Stakeholder engagement in sustainability reporting: a classification model. Corporate Social Responsibility and Environmental Management, 27(5), 2071-2080.

Tyndall, G. R. (1988). Supply-chain management innovations spur long-term strategic retail alliances. Marketing News, 22(26), 10.

Venkatesan, R., Kumar, V., & Reinartz, W. (2022). Customer relationship management in business markets. In Handbook of Business-to-Business Marketing (pp. 335-358). Edward Elgar Publishing. https://doi.org/10.4337/9781800376878.00028

Wang, H. (2014). Theories for competitive advantage. In H. Hasan (Eds.), Being Practical with Theory: A Window into Business Research (pp. 33-43). Wollongong, Australia: University of Wollongong.

Wang, W., Su, C., & Duxbury, D. (2021). Investor sentiment and stock returns: Global evidence. Journal of Empirical Finance, 63, 365-391.

Zhao, Z., Meng, F., He, Y., & Gu, Z. (2019). The influence of corporate social responsibility on competitive advantage with multiple mediations from social capital and dynamic capabilities. Sustainability, 11(1), 218. https://doi.org/10.3390/su11010218

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Humanities and Social Sciences Journal of Pibulsongkram Rajabhat University

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Any articles or comments appearing in the Journal of Humanities and Social Sciences, Rajabhat Phibulsongkram University, are the intellectual property of the authors, and do not necessarily reflect the views of the editorial board. Published articles are copyrighted by the Journal of Humanities and Social Sciences, Rajabhat Phibulsongkram University.